Mother of All Financial Bubbles

By all measurable means, it looks as if we are now experiencing what appears to be the mother of all financial bubbles, and with the “Trump Rally” remaining in full play there appears to be no end in sight. We’ve been living with it so long now that it’s difficult to even detect its broad outlines. As a reminder, a bubble exists when asset prices rise beyond what incomes can sustain. Florida swampland in the 1920s, tech stocks in the late 1990s, or Toronto real estate today — all are fine examples of this.

The US government and the private banking cartel known as the Federal Reserve, in cahoots with a very compliant and complicit mainstream media, are doing everything in their vast and considerable power to convince us that we are living in a golden era of risk-free prosperity, and that tomorrow will be even better.

On the surface, the case for an equities selloff looks pretty straight-forward: we’re stretched on almost every metric you care to consult, volatility is unsustainably low, and if volatility should spike, programmatic selling will inevitably exacerbate a drawdown. Throw in rising political uncertainty and an indeterminate time table for tax reform and fiscal stimulus and you’ve got a recipe for disaster, right? Not so fast. There are many times where the fundamentals are not in control of market behavior, and we are right now in the midst of one of those times.

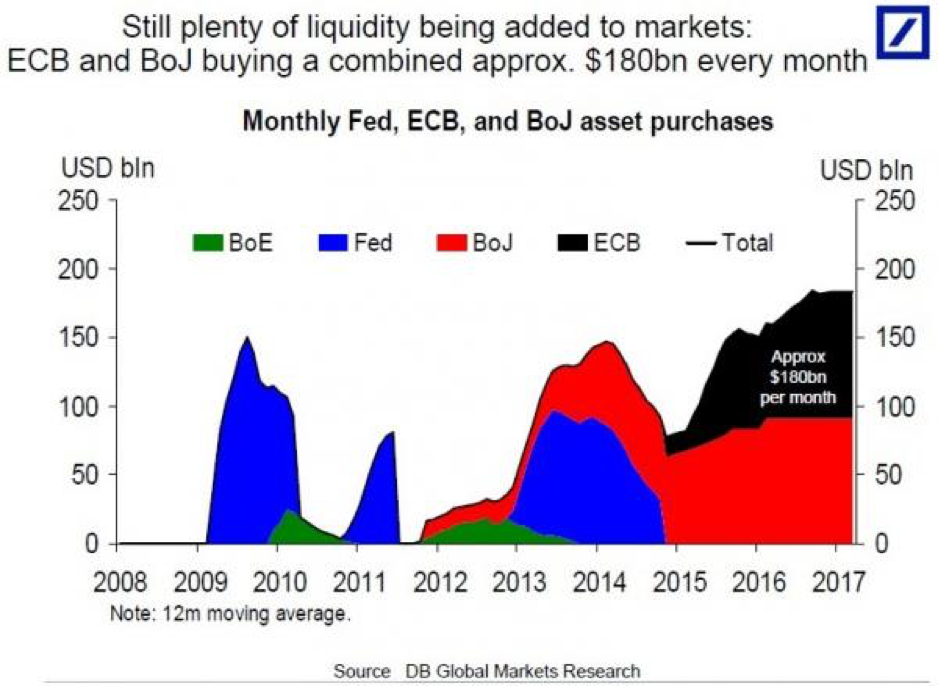

Liquidity Injections

Why, you may ask? Because the Central Banks around the world continue to blindly inject liquidity into the markets (see chart below) and until that ends, the party is likely to continue.

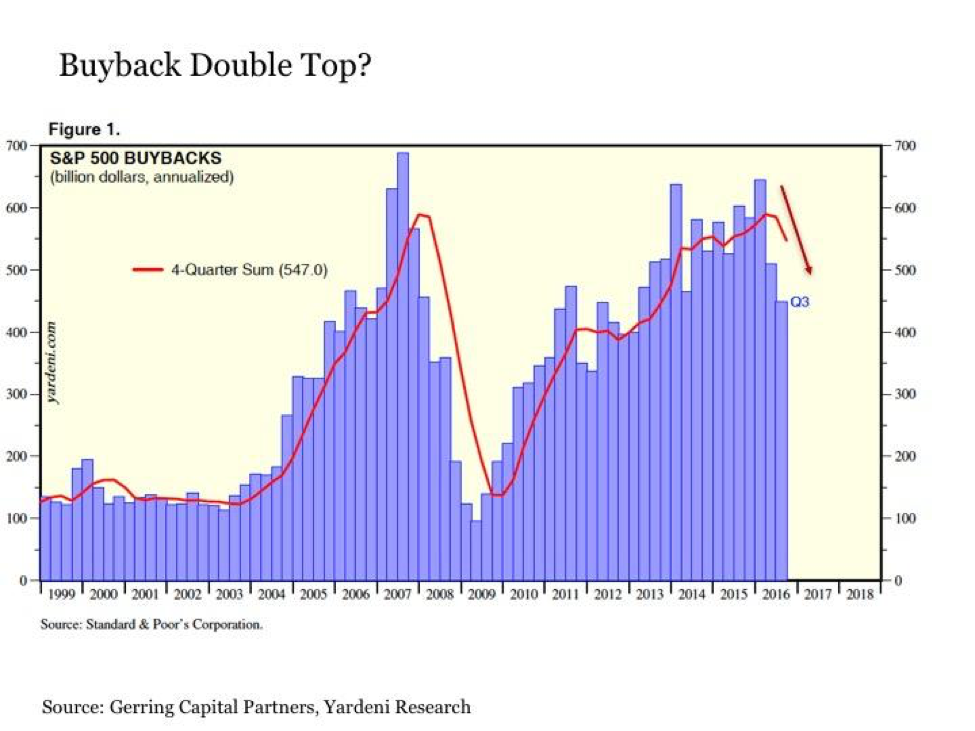

One key beneficiary of that liquidity has been the explosion in corporate buybacks. Stock repurchases have been a critical driver of stock market returns over the past five years. This raises a critically important question – how likely are they to continue going forward? At some point, the amount of debt and financial leverage that a company can take on reaches an upper bound, and it appears that we may be approaching this limit in 2017, if we have not already surpassed it.

There is no free lunch. Just like artificially inflating asset prices through relentlessly easy monetary policy is not without costs, so too is engaging in aggressive share buyback activity in order to return cash to shareholders and boost earnings per share. This is particularly true when a primary source for the funds to support this rampant buyback activity has been tapping low-cost debt markets in recent years for the purpose of buying back stock and paying dividends to shareholders.

The already historically expensive stock market is increasingly losing this critically important tailwind. While it is too soon to declare the bull market in jeopardy, particularly given the fact that stocks cannot seem to be kept lower for hours much less for a trading day or more in recent weeks, this is an important indicator that warrants close attention in the months ahead. For if corporate buyback activity goes the way of the individual and institutional investor circa 2008, stocks may struggle to hold on to their increasingly lofty valuation perch.

In the face of these headwinds, we continue to participate in the rally, albeit cautiously. Despite the overstretched fiscal policy, there are still reasons to stay involved. The market’s confidence derives from two things. First, the economy continues to advance in line with expectations and continues to show firming inflation. However, this isn’t getting out of hand. That’s a good thing, because those core drivers of the U.S. economy stepped down in trend, then we would be looking at a very unpleasant experience for equities. But we are not there and there is no reason to expect us to be there soon.

We are currently still long equities, with positions in the Nasdaq, Industrials, Retail, and other select sectors. As we progress through the current expansionary phase of the economic cycle, we look to add further positions in sectors that will benefit. In particular, American shale oil production is rocking the world. Should Mr. Trump impose Federal taxes on the importation of foreign oil and, at the same time, provide tax credits for the exportation of American oil then the gauntlet has been laid and the consequences, in my view, will be enormous. Here is one significant way to balance the American budget and off-set the proposed increases in military spending and infrastructure. I believe, in some form, that this will be a forthcoming event. To that end, I am looking to take a position in the energy sector when the opportunity presents itself. This sector, along with the building materials and industrial sectors, should significantly outperform over the course of the year.

We adhere to strict disciplines in our portfolio strategy and we will not chase returns. All our tactical positions are based on our proprietary models, which provide ideal entry and exit points. Our cautious positioning and entering new positions at key points will allow us to meet our long term performance goals while preserving capital through effective risk management.